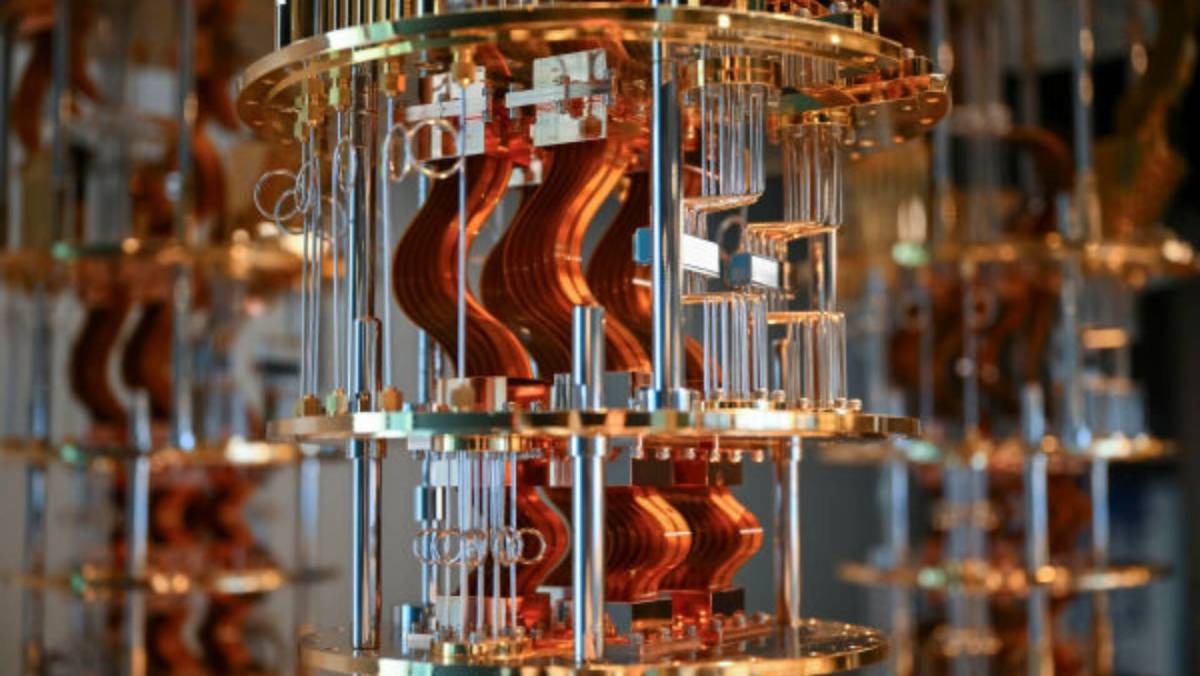

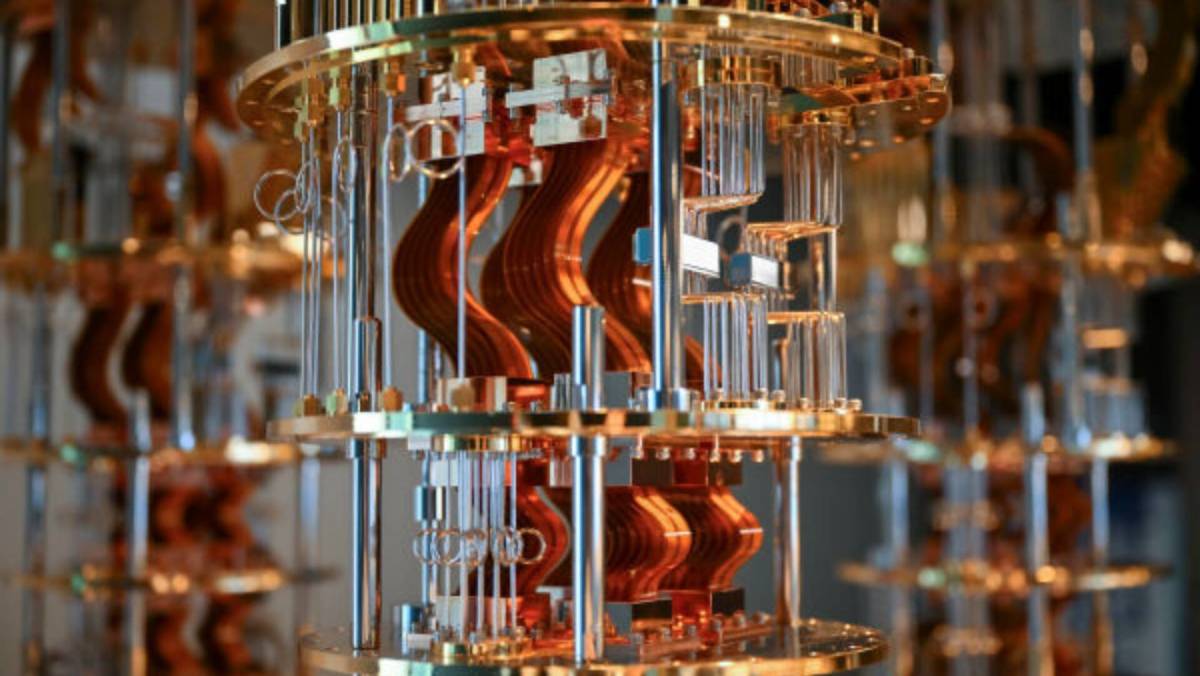

Many people think Quantum computers will be the next big thing after artificial intelligence, or bring AI to the next level.

Here’s why: If we could build a quantum computer that doesn’t suffer from errors, it would be possible to do some calculations that would take a ridiculous amount of time on supercomputers in a much shorter amount of time.

The only “minor” problem with this is that no such computer exists. Many companies are trying to build one and even selling some computers and special equipment with the “magic” quantum sauce.

But if any of them made a real breakthrough, it would send a shockwave through the industry, and nothing would ever be the same. The company would also be drowning in money.

Unfortunately for investors, such breakthroughs keep getting moved to somewhere between five and 10 years into the future. This is why quantum computing companies need frequent injections of investor capital to keep the research going until success is achieved.

One of them is Quantum Computing.

Quantum Computing revenue declines to just $61,000 in Q2

On August 14, Quantum Computing (QUBT) reported its results for Q2 of fiscal 2025.

“What sets us apart from others in the quantum computing space is that we are not chasing theoretical performance; instead, we are delivering purpose-built machines and the components that customers are deploying today,” said Quantum Computing CEO Yuping Huang during the earnings call.

Related: Analysts revamp Apple stock price target on iPhone 17 launch

Quantum Computing earnings highlights:

- Revenue of approximately $61,000 compared to $183,000 in Q2 2024

- Gross margin 43% compared to 32% in Q2 2024

- Operating expenses totaled $10.2 million compared to $5.3 million in Q2 2024

- Net loss attributable to common stockholders of $36.5 million, compared to a net loss of $5.2 million in Q2 2024

- Cash and cash equivalents at June 30, 2025, were $348.8 million in same quarter last year

- Total liabilities at June 30, 2025, were $30.1 million

The company stated that the increase in net loss was primarily due to a $28 million non-cash loss on the mark-to-market valuation of the company’s warrant derivative liability, which relates to its merger with QPhoton in June 2022.

QUBT stock crashes on private placement

The company reported on September 21 that it has entered into securities purchase agreements with institutional investors.

These involve the purchase and sale of about 26.9 million shares of common stock in an oversubscribed private placement, expected to result in gross proceeds of $500 million before deducting offering expenses.

More Quantum:

- Microsoft CEO sends a surprising message on quantum computing

- Nvidia’s new investment is a game-changer for quantum stocks

- IonQ CEO revamps quantum computing forecast for 2025 after shares tumble

Huang said this financing round will bring the company’s total gross capital raised since November 2024 to approximately $900 million.

He stated: “This financing further fortifies our financial position and enables us to execute our multi-year growth plan, including the acceleration of commercialization efforts, strategic acquisitions, the expansion of sales and engineering personnel, and the strengthening of our manufacturing capabilities.”

Related: Bank of America revamps Palantir stock outlook after AIPCon

Because private placements increase the number of shares outstanding, they can dilute, or reduce the percentage of ownership, of existing shareholders.

The stock took a dive on the announcement, and at last check, QUBT shares were trading 14% lower near $20.

The company intends to use the net proceeds from the offering to speed up commercialization efforts, make strategic acquisitions, and expand sales and engineering personnel, among other things.

This isn’t QUBT stock’s first crash on a private placement; a similar crash occurred in June.